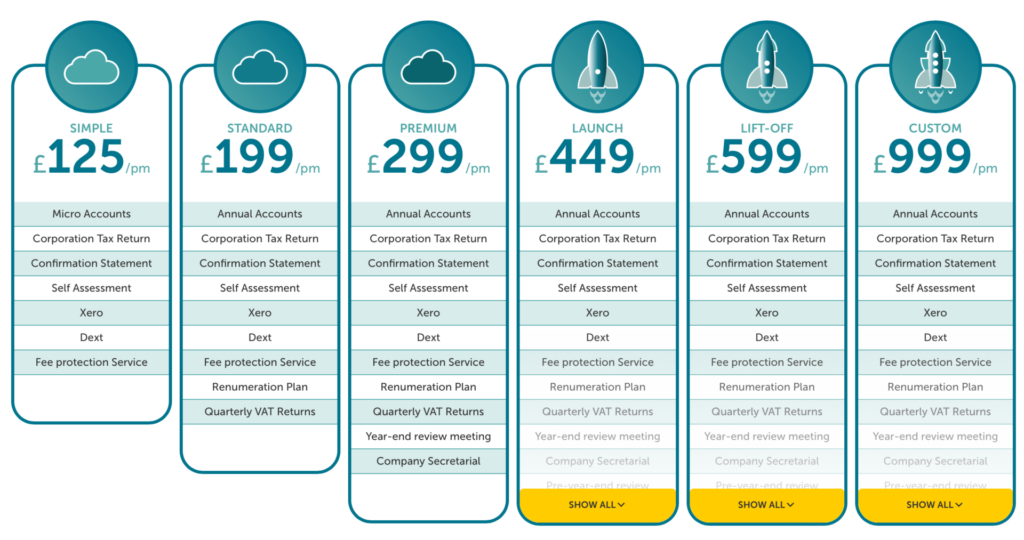

Cloud Accountancy

Accounting in the cloud means you can automate everyday business tasks, get “real-time” financials and run your business from wherever you are.

There is no software to install!

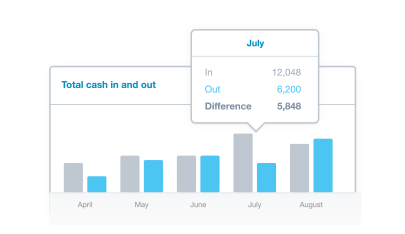

Real-time financials

Bank balances

View bank balances from multiple connected business bank accounts

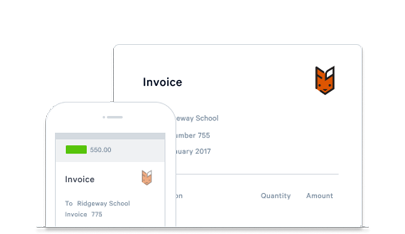

Sales invoices & bills

View all your invoices and bills in one easy to use interface

Account summaries

Access nominal account summaries on one easy-to-manage screen

Businesses of all sizes could benefit from keeping their accounts in the cloud. Our preferred cloud accountancy system is Xero and we support start-ups through to multimillion pound turnover businesses in getting the most from their cloud accounting.

If you want your business to work smarter and faster, cloud accounting is the way to go.

Why XERO?

From tradesmen to retail, manufacturing to dentists, developers to tech – whatever your business, Xero could make your life easier!

Our Top 6 Benefits:

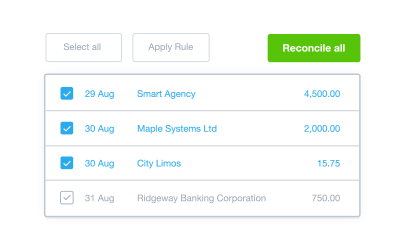

- Work more efficiently

- Reduced manual data entry

- Reduce human error

- Easy to view customisable reports

- Get paid faster via online invoicing

- Integrate with over 800 connected apps.

Don’t take our word for it

Helps me make the right decisions.

“I know I can count on Ad Valorem for sound and reasoned financial advice – the kind that helps me make the right decisions.” Neil […]